Free Trade is supposed to enhance Open Markets, but the facts shows that Free Trade kills competition. It makes oligopolies and destroys truly open markets.

Open Markets require many players

It is axiomatic in economics that an open market requires many players, and that competition only works for maximum effect when there are open markets.

The experience of the last 30 years has shown a trend towards agglomeration, with smaller firms being swallowed up. This is done in an attempt to achieve a level of market power and cost efficiency resulting in a firm being of sufficient size that it can compete with all comers, and dominate a market.

If economists were not blinded by their own theories, they would realize that this trend is antithetical to their “ideal world” of perfect competition. Instead of combating this trend, they are prepared to explain it away as a limitation to their micro-economic theories.

Open Markets deliver mixed results

The effect of open markets is clearly seen in the agricultural sectors especially in subsistence economies. Here the farmers deliver their products to the market and receive whatever the customers will pay – they are entirely price-takers.

No-one wants to be a price-taker in an open market. We all want to be price-setters. In the agricultural sector this can only be achieved if the producers gather together in a collective, and only deliver to the market those goods that must be sold, because they will perish, or those goods that will receive the best price that the market is likely to pay (in the medium term).

The ideal situation is where the market sets the price, based on supply and demand, but where both buyers and sellers have equal power. Yet this never can be achieved under Free Trade. This is because the lowest-cost producer has virtual monopoly power.

The end result under Free Trade, is that open markets for many goods and services become a virtual fiction, with a few operators holding an unconscionable level of monopoly power, by virtue of operating in an oligolopolistic space.

Restoring Open Markets in the US via a Cash Destination Tax

The US Republican proposal for a Cash Destination Tax has the potential of restoring a more competitive market situation in the United States. This is because US producers will gain a slight advantage over those producing goods and services overseas. This will arise because only the costs incurred in the United States will be deducted from income when assessing income tax payable by corporations.

The slightly higher prices that United States firms will be able to charge for sales within the United States will encourage additional producers to enter the market. As well as improving the Open Market status of the US economy, wage rates for US workers will rise, bankruptcies will reduce, and the neglected cities of the US will revive again.

However, one aspect of the Republican proposal for a Cash Destination Tax is totally unacceptable. This is the proposal not to charge Income Tax on any revenue earned by exporting outside of the United States. Surely, the proponents of this aspect of the tax know that importing countries will be entitled to treat all US firms as if they were dumping their goods. One thing is for certain, the EU will impose countervailing dumping penalties on all imports from the US. It is also the way of such things, for dumping tariffs to include a penalty component.

If the Republicans insist on “no Income Tax on Export revenue”, we can look forward to a full-throated trade war. Good luck with that! It won’t end well.

Too much Competition is Too Much!

Who is too thick not to realize that getting imported goods at a price 20% cheaper is not worth the social dislocation that the current Free Trade ideology is creating?

Apparently, most of the people protesting against the Donald Trump agenda are as thick as bricks.

Yes, the Obama years saw the US economy recover, albeit ever-so-slowly, from the sub-prime induced difficulties. However, the EU and the Obama administration were too thick to realize that the Global Financial Crisis merely exposed the soft under-belly of the economies of the Western world. Radical changes are required to fix this situation, and the world can thank God that the US electoral college decided to elect the radical Donald Trump, rather than Hillary Clinton, who would have continued Obama’s failed policies.

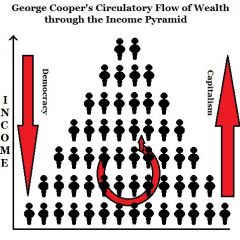

There can be no investment where there is nothing in which to invest. For most industries, this is a problem caused by Free Trade. Who will invest in the developed world when almost everything can be made more cheaply in Asia. Yet the irony is that these cheaper goods have to be exported back to the developed world, with the markets in the developed world drying up because the jobs supporting them have gone.

Undeveloped economies need trade reform

Undeveloped nations should give their utmost efforts to making the farmers more prosperous, with higher prices being achieved for their produce. This will require a modification of their own Open Market theories, such as discussed above, so that their markets work for the good of their own nations, not for the benefit of global capital.

Look after yourselves! Capitalists are required to look after their shareholders, not to look after the nations in which they operate. Oxfam may fulminate, but its pleas will achieve nothing if national governments do not look after their own people.

One thought on “Open Markets – not Free Trade”