Donald Trump campaigned on getting rid of Obama’s insurance healthcare model, and replacing it with a healthcare scheme that “everyone would love.”

An ideal healthcare model cannot be based on insurance. The problem with such a scheme is that there is no upper limit to the cost of an insurance based scheme. So, in the USA, healthcare is running at 17% of GDP.

The problem with an insurance-based healthcare scheme is that there is no direct connection between the cost of the service provided and the payment for the service. Insurance companies may try to limit their payments, but are clearly failing to do an adequate job.

Healthcare Funding

Healthcare funding is inherently difficult. Everyone wants the best healthcare that can be provided, but not everyone can pay the price. In fact, no country can actually pay for every healthcare need or demand of its people. A rational approach to rationing healthcare spending is required. This should target to meet, at least, fundable critical needs from a general pool.

Doctors are the key

There are many doctors who have entered the health profession primarily to serve the public, not to make $1 million dollars a year in fees.

Such doctors would be prepared to provide services to patients on a government-set fee for service. Those doctors who accept this arrangement would be legally blocked from charging their clients anything in addition to the government-set fee.

The fee should be set to provide a generous return to the doctor, taking into account a proper return for the years of study, expertise and work involved. Where there is a shortage of available GPs and specialists, an increased fee will be provided while this shortage exists.

A scheme like this would provide for a government funded fee for service for GPs and supported in-hospital medical procedures. Such a scheme is likely to be much cheaper to the US economy than the current insurance-based scheme.

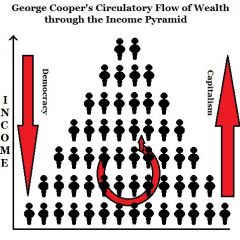

This scheme could be funded by a fixed Federal levy on gross personal income and “net business turnover” (turnover less wages cost) in the USA. It should be set prudently at a high enough level to meet the cost. If this levy was reasonably set at less than 17% it would represent a net saving to the US economy. Based on this funding model, healthcare cost is likely to be less than 10% of personal income and net business turnover.

State-funded hospital care

State-funding of hospital functions on a fixed fee for service arrangement is a viable method that has been used elsewhere.

Non-profit hospitals could opt to be state-funded, and new state-owned hospitals could be commenced. Those hospitals that accepted this arrangement would be legally blocked from charging their clients anything in addition to the government-set fee for the nominated procedures.

This scheme should also be funded out of the Federal levy.

Medicaid Healthcare Funding

No further Medicaid funding would be required, and any other Federal subsidies for medical care would end.

Private Healthcare Insurance

For those who prefer to be privately insured, and to use current fee-for-service arrangements, this can be accommodated within this system.

In this case, the insurer would be required to make a claim for a percentage of the fixed fee (say 80%) from the Federal government, based on the same fee-for-service scheme, for supported services, used by doctors and hospitals .