In an entertaining article in The Australian, 17 Sept 2016, Paul Kelly discusses the idea of Australian Exceptionalism.

According to Kelly, the idea of Australian Exceptionalism goes back to Alfred Deakin, PM 1903-4, 1905-8 and 1909-10. It included control of immigration, protection of industry and wage arbitration, leading to (or arising out) a sense of egalitarianism.

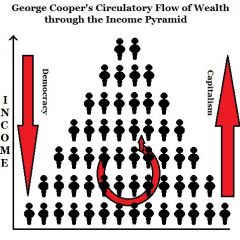

Apparently, Paul Kelly, Peter Costello, Henry Ergas and William Coleman (an economist at ANU) all want to smash Australia’s egalitarianism in the search for a now elusive platform of “reform.” However, those who support Democratic Capitalism love the Australian sense of egalitarianism, and would dearly love to bring these blind economic reformers to their senses.

Immigration

There is only a minority of people in Australia who want to throw open our borders, like the US did at the beginning of the 20th century, and say, “Whoever wants to come, come now!” Australian know that their precious and hard-fought-for “exceptionalism” could not stand in the face of millions of uninvited arrivals. Europe now knows the same thing: it learnt that lesson the hard way.

Protection of Industry – $A

Australia now knows that its hard-won industrial base cannot survive (and has not survived) an over-valued currency. Led by the Reserve Bank of Australia, the nation has made every reasonable effort to bring the currency down to a more manageable level.

The relative value of the $A is not divinely or even particularly rationally set. It is a balance between those who want to buy $As and those who want to sell $As. As the Central Bankers of the world continue their ridiculous plan to revive their national economies by cutting interest rates, their national economies dive into a hole. This is because they are obsessed with a zero-tariff regime (but they haven’t worked yet that this is the source of their problems).

Tiny Australia is at the end of the line. We have to cut our interest rates in order to slow down the flow of funds into the country in order to stop our currency becoming overvalued. Yet there is little we can do to make investing in Australia less attractive. It is a safe haven for hot money from Asia; and the Australian economy is better run than any other G20 nation. Who wouldn’t want to invest in Australia, or live here for that matter? (A few, like Germane Greer!)

So, industry protection can be established indirectly by managing the exchange rate. This can be done with measures designed to make it harder to invest in Australia. (We have enough of our own money to fund all existing Australian businesses – we didn’t need to sell the Melbourne ports to China and other overseas buyers.) The RBA can also keep interest rates low, in order to discourage hot money chasing higher interest rates in this nation.

Protectionism – Tariffs

Industry protection can also be established by re-introducing tariffs. Yet with the current exchange rate regime, a uniform tariff of 20% on all goods is likely to over-cook the economy. However, an increase in all tariffs up to 10% is certainly worth examining. If that is too difficult to accept or implement, then an implicit 20% tariff on all goods and services being purchased by an Australian government authority could be introduced.

In regard to services, establishing a 20% “International Outsourcing Tax” would offset the massive cost differential hurdles of current international outsourcing. These include: Payroll Tax, Superannuation, generous leave arrangements, health and safety regulations.

Wages Policy

Some reform is certainly needed in the industrial relations area. Here a new government could take advantage of the “reforms” implemented by Julia Gillard under the Fair Work regime. The result or her reforms is that there is no longer any real need for unions in the wages area, since the government sets minimum wages for every class of work.

Now there is only a place for unions in negotiating enterprise agreements, conditions and in health and safety. These can also go if Fair Work takes over these roles and gets rid of the rorts currently supported by unions. These include employment-destroying double time penalty rates for Sunday work.

Fair Work Australia could also be prohibited from promoting union membership.

Egalitarianim

It would be a great loss if Peter Costello’s vision for Australia, invoking the perceived need for hyper-competition for the nation’s businesses, became the order of the day. If only the best-in-the-world can thrive in his Australia of the future, we can say goodbye to social cohesion, and hello to the dysfunctional situation currently found in so many American towns and in north of the United Kingdom.

May heaven preserve us from this kind of future.