If international trade is to be of benefit to every nation upon the earth, then tariffs must come back into our economic vocabulary.

Tariffs are not evil

Tariffs are a supplement to the automatic stabilizer of an exchange rate. They help iron-out the development disparities within a nation and are necessary if a national government is determined to do whatever it can to ensure that there are jobs for people of every skill and education level.

If handled correctly, tariffs will have two results. While all imported goods will be more expensive, some sectors of the economy that would otherwise die without tariffs will survive. The question to be considered is, “What is the trade off for more expensive imported goods?” The answer should be, “Jobs for those who would not otherwise have jobs!”

The corollary of imposing tariffs is, “What is the trade off for cheaper imported goods?” The answer has been, “Jobs will be lost, with no sign of them ever been regained!” For those who are skeptical about the “never” aspect of this answer, just consider the Enclosure Laws in England in the 17th-18th century. They resulted in 100 years of chronic unemployment and poverty in England. This is not just a historical aberration. Modern attempts to fix the structural imbalances of Western economies via monetary policies, have not worked. Here is a prediction that is beginning to be recognized as true in the world of Central Bankers: they will never work! BoJ’s “decision” to aim for 10 year interest rates at 0% must soon be recognized as nuts!

Rather than Tariffs being “evil,” it is the zero tariff objective of the WTO that is evil, and has brought on the unremitting distress of the current economic situation.

Tariffs will not end World Trade

Re-instating tariffs will not end globalization, or world trade. It will just regulate that process and restore economic control to national legislators.

Even if every nation imposed a 20% tariff on all imported goods and services most items of global trade would continue. This is because the Real Advantage held by some nations in the production of those goods and services will mean that trade in those goods and services will continue.

Take an example of simple manufactures. Australia buys most of its clothing from China and Bangladesh. Even at retail, a T-Shirt often costs only $A6. With a 20% tariff it will cost $A7.20 (if the margins stay constant). No-one will notice!

Take an example of complex manufactures. The NSW government is planning to buy trains from South Korea, because they are less expensive than Australian-made trains. Also the history of train-manufacture in Australia has been fraught in recent times. It is quite unlikely that a 20% tariff would change that decision, although it would impact the dynamics of the decision-making process a little. Once again, since the decision is likely to be unchanged, and the cost will only be 20% more (rather than, say 40% more if made in Australia) then no-one will notice.

Tariffs will Save Jobs

Although, under the scenario I have painted, the introduction of tariffs, even at the relatively high level of 20% on all goods and services, would not end world trade, in other areas it will mean that domestic production can continue.

In cases where the imported cost is currently less than 20% below the locally manufactured cost, a 20% tariff would mean that local manufacture will be preferred over imported supply. For an Australian example we can look at steel manufacture. Here the existing South Australian plant is balancing on the brink of being uneconomic. A 20% tariff would change that situation overnight.

Tariffs will Restore Prosperity

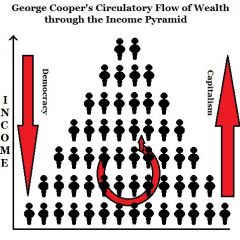

Most Western nations are now consumer societies, where most jobs are created by providing goods and services for other consumers. However, for consumer societies to work, there must be jobs for everyone, for everyone is a potential consumer. Here potentiality is converted into action by having money, and for most of us money comes from having a job.

The USA is the most telling example of the failure of this principle because of defective economic orthodoxy. Here we see the impoverishment of US “Middle Class” since the 1980s. This has followed the zero-tariff ideology pushed by the economic elite. This ideology was even supported by the Democratic President, Bill Clinton, and also by the Republicans. The consequences of the Democratic Party’s acceptance of this bogus theory is now being felt on the streets of their impoverished cities. Since Hillary Clinton also believes that America should continue down the same path upon which her husband set the country, there will be no saving American cities if she is elected. Just more ringing of hands and ineffective “black lives matter” protests.

The elite pushing zero tariff policies now has its own world body, namely, the World Trade Organization. That body, and those who support it, can take the majority of the credit for the current economic malaise impacting on the West. Its malign influence is now spreading to emerging nations, since they are finding limited scope to sell their goods. This has happened because the consumer/worker in the West has been crushed by the trade policies of the US.

The same elite who pushed for zero tariffs are now “subtly urging” the WTO to making it more difficult for UK to leave the EU. The best outcome of that talk could be for the UK not to join the WTO and for the UK to prosper without its dead weight of WTO rules around that nation’s neck.

Tariffs are better than Quotas

While quotas can have a place in food production, since it is natural objective of every nation to maintain a large measure of self-sufficiency in food for cultural and defence reasons, tariffs are more economically efficient than quotas. This is because they allow the market to establish a close-to-optimal division of labour between economic sectors.

Quotas are not economically efficient. They can result in much higher prices of now-scarce goods, even leading to a doubling of prices. They can also result in super-profits for importers who have a licence to import up to the quota level, since they are now dealing in scarce goods. Of course, that can be partially compensated by using an auction system for selling the licences to import.

Sectional Impacts

There will be downsides in using trade controls via tariffs for those sectors of the economy that are very heavily dependent upon exports. This, too, will require a balancing act by the national government in order to ensure that no sector of the economy is unreasonable impacted by the introduction of tariffs. This can be done via rebates for the tariffs embedded in their exports, and by targeted measures designed to offset the extra costs that they have to bear compared with producers in other nations. It is worthwhile to address all such matters, since everyone in the nation benefits from a cohesive society in which everyone has the realistic chance to obtain a job.

2 thoughts on “Tariffs are not a curse-word”