Scott Morrison has overcome the attempt to re-introduce class warfare into the Australian electoral system with a “steady as she goes” campaign strategy.

Labor’s Campaign

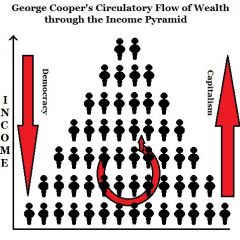

In a carefully calculated attempt to re-invigorate union control of the Australia economy, the ALP set out a programme to target all Australians who were not unionists. This programme included the following “difficult to explain” elements:

- Eliminating Franking Credits for retirees in self-managed superannuation funds, but keeping them for retirees who are in externally managed Superannuation funds, which are mainly union-managed funds.

- Supporting the proposition that there should be an increase to the minimum wage without regard to the possible negative impact on jobs.

- Allowing lawless union activity and removing the “industrial umpire” in the construction industry.

- Radical action on climate change beyond that agreed at COP21 and beyond that committed to by other comparable nations, with little real consideration of the employment consequences of this approach. Given its rhetoric, and reliance on Greens preferences, the ALP were unable to articulate a policy fix to work around this. This did not trouble voters in Melbourne or Canberra, since they did not perceive a risk to their own jobs, but it did worry voters in Queensland.

Maximising Scott Morrison’s win

Continuing failure of the Liberals to win over Canberra’s voters (and the opinion-makers at the ABC and SBS) will be a cancer on future Liberal policy making. In addition, the time is approaching when the ALP will not be able to govern in its own right, but in a future time its only hope will be to govern in coalition with the Greens. Already, the ALP cannot win many seats without Green preferences.

For the Liberals, it will not be enough to point out the overt socialism of Green leaders or the economic dead-end of Labor’s class war. Furthermore, the Greens are already starting to show more pragmatism than the ALP on policies like the Franking Credits changes, with plans to protect less wealthy investors. The challenge for the Liberals will be to come up with their own version of “reasonable and easily defensible policies.” Here are some suggestions for immediate action:

- Fix the “wages drought” by arguing for a $1 hour increase in the minimum wage in this year’s Fair Work hearing.

- Make Mabo Day a Federal public holiday.

- Explain that Australia is cutting its CO2 emissions in accordance with its commitments to COP21.

- Explain that the Coalition has a policy to provide dispatchable electricity via Snowy 2.0.

- Protect jobs in vulnerable sectors, such as horticulture, via modest tariffs.

Wages Drought

The government and the Reserve Bank have already agreed that inflation should be between 2% and 3%, yet it is currently running below that level. We know that inappropriate across-the-board increases in wages are the main cause of runaway inflation. Surely the corollary of that is that inappropriate wage-freezes are the cause of inflation running at too low a level. Therefore, it follows that a significant minimum wage increase at this time is appropriate. Don’t drop the ball on this, Scott Morrison. If you do, you will be opening up the field to the ALP to foster discontent.

Most of Australia’s export industries will not be hurt at all by this change, as they operate at the other end of the wages spectrum, with mining, medical research and IT sectors paying well above the minimum wage to most of their employees. The tourism sector could suffer some short-term impacts, but it is a highly vulnerable sector in any case with many other factors playing a more important part than the wages paid to minimum wage employees.

The import-competing sectors could suffer some pain, but the government has the means to address this issue by another mechanism, discussed below.

A change in the minimum wage will be much more effective in restoring balance to the Australian economy than can be achieved by cutting interest rates since that is likely to have other and unmanageable consequences.

Mabo Day

Most Australians recognize the importance of Australia Day. It recognizes the beginning of European settlement in this nation; most Australians are Europeans. On the other hand, Mabo Day could be an equally important day in Australia’s calendar. It would be a day to remember when the original inhabitants of this land began to get legal title to the land upon which they are still living. It can be a day when Aborigines, Torres Strait Islands and the European and other immigrant peoples remember and celebrate the original inhabitants of this land. Scott Morrison, don’t you think it deserves to be recognized?

COP21

In Paris, Australia made a voluntary commitment to cut greenhouse Gases by 26% to 28% by 2025 from 2005 levels.

Since Australia only emits 1.3% of the world’s greenhouse gases, it is not possible for Australia’s action to have any measurable impact on global warming. Therefore, it is appropriate for Australia to be a follower, not a leader in this matter, especially since its commitments to COP21 follow that requirement. Certainly we can do more, provided it can be done without seriously damaging our own economy and without destroying the jobs and incomes of ordinary Australians. This is the lesson of the recent election, which was claimed to be a “referendum” on this subject. The nation’s action on climate change should bring the nation together, not divide it, as the ALP and the Greens wanted to do. On this point, Scott Morrison was clearly correct.

While many in the electorate like the idea of Australia leading the world on climate change action, and probably most of the voters in Canberra (which includes the civil servants advising the government and the nationally-funded broadcasters, the ABC and SBS), it will have a cost in terms of jobs, a point which voters in Queensland clearly perceived.

In addition, Australia should not be party to the worldwide green conspiracy to deprive India and other emerging nations of access to cheap electricity via Australia’s coal. When the West and China emit less CO2 than India it may have a moral right to dictate how India should proceed in this matter. Whether it should do so, even at this point, is a matter of geopolitics as well as moral arguments.

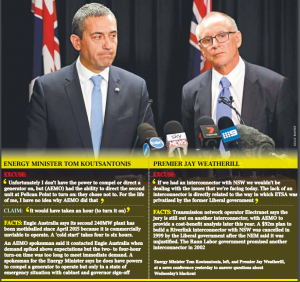

Snowy 2.0

Only the Coalition has a workable policy to turn generated electricity into dispatchable power. This important contribution to this subject was made by the former PM, Malcolm Turnbull, being a policy that Scott Morrison has retained. Of course, Snowy 2.0 is only a start, but this “solution” is likely to be repeated, with the Kidson power project in North Queensland also being indirectly supported by the Queensland Labor government.

On this question, Labor and the Greens have been very quiet, hoping not to give any credit for real action on climate change to the Coalition. Scott Morrison and the Coalition should not allow this policy vacuum in their opponents’ rhetoric to continue to go unchallenged.

Tariffs

All major parties have a blind spot on tariffs, believing for some reason or other that minimum wage Australians can compete with people overseas on half, quarter and even one-tenth of Australian wages and conditions without any problems.

This is a manifestation of the arrogance of the Canberra bubble and I seriously hope that Scott Morrison can burst this bubble.

Critiquing Some Labor Policies

Franking Credits

The system of Franking Credits is an innovative approach to avoid double taxation for Australian investors. It was introduced by a previous ALP government. It had the significant benefit that overseas investors in companies of all kinds were no longer better treated than local investors (since overseas investors are only taxed at a notional rate on dividends and interest earnings). The outcome of the ALP’s tinkering could have been the beginning of the end of this scheme in its entirety, a result in which Labor’s class-war warriors would have rejoiced, urged on by the Liberals’ hard-right “free trade” faction. A plague on both their houses!

Negative Gearing

The system of negative gearing for housing investments has been a thorn in the side for taxation system designers of all political persuasions. A previous ALP government tried removing it, but had to unwind the change because it immediately caused property rents to increase. Undeterred, ALP’s Bowen planned to try to do this again. The problem with this plan is that rents provide a very poor return on residential property returns, with the shortfall made up by immediate tax deductions for the loss on property investments and the hope of future capital gains. Ignoring the likely adverse outcomes of a policy platform is not recommended.

Capital Gains Tax changes

There is a fairness aspect to the Capital Gains Tax discount and there is an economic incentive aspect. The fairness aspect relates to the “lumpy” nature of capital gains since, for individuals selling a business and receiving a capital gain, this could be a once-in-lifetime event. In this case, taxing at the full marginal rate of tax applicable in that year would be unfair. Even though averaging could be introduced at this point, there is a more important element that should be included when considering capital gains taxes. This relates to the nation’s need for capital investment and capital accumulation in order to maintain the nation’s prosperity into the future. Encouraging investment via the capital gains discount should help to build up the nation’s capital; even negative gearing also serves this purpose. At present, Australia has a problem with insufficient capital investment. The need for more investment is a matter that does not appear to have been considered by the ALP when proposing to reduce the capital gains discount and their changes to negative gearing. While their proposals had a ready audience among those who do not invest for the future, the ALP has no excuse for not putting national interest ahead of a “cheap win” in these matters.

Conclusion

Scott Morrison is to be congratulated for running an effective campaign, highlighting some of the inadequacies in the “bold agenda” put forward by Labor. It is now up to the Prime Minister to lead a government that really does work for all the people, not just for those who voted for the Coalition.